Austin, TX

The next market we are featuring is that of Austin, TX. We are very excited about Austin for several reasons but thought we could share some of the numbers, descriptions and pictures to help illustrate the city as we view it from an investment standpoint.

Profile: The city is home to development centers and headquarters for many technology corporations, adopting the nickname Silicon Hills in the 1990s. Recently, however, the current official slogan promotes Austin as The Live Music Capital of the World, a reference to the many musicians and live music venues within the area. One major event, South by Southwest, is one of the largest music festivals in the U.S., with more than 2,000 performers playing in more than 90 venues around Downtown Austin over four days every March. Austin is home to the University of Texas at Austin, the flagship institution of the University of Texas System. (Forbes Best Places for Business and Careers)

Market Analysis:

Austin has experienced some of the most explosive growth in the US over the last several decades. From 1990 to 2000 they increased 47.7% and from 2000 to 2010 an additional 37.3%. The greater Austin metropolitan population is now sitting at 1.9M. These increases are nearly double that of Texas and 4 times that of the US. Also factoring in that Austin is a major education hub, with 14 colleges and universities in the Austin area educating 183,598 students, we can see why their college education attainment rate is at better than 40%.

2003-2013

Just to illustrate the growth we felt pictures could do more to tell the story than percentages.

Austin 1997

Skyline 1997

Austin 2012

Skyline 2012

What is exciting about Austin is that those changes are just a fraction of what the skyline will be in another 5-10 years with more than 50 new projects under construction and in planning.

Under Construction and Planned 2014

Here are a few of the projects under construction or recently finished. To check out more of the numerous projects go to: http://www.downtownaustin.com/business/emergingprojects

JW Marroitt

Fairmount

Westin

Colorado Tower

Recently completed and under construction is the new Dell Medical Center and UT Medical School

Dell Medical Center Rendering (Opening 2016)

$335M UT Med School and Dell Medical Center

Dell Children's Hospital

Overall, we are very bullish on Austin for many reasons. Primarily is the fact that an explosive population growth has caused a strain on housing supply, which has driven prices up in equal portions. However, the caveat that makes this fact so financially lucrative is the fact that Austin is still one of the most affordable major metropolitan cities in the US, which bodes well for future growth.

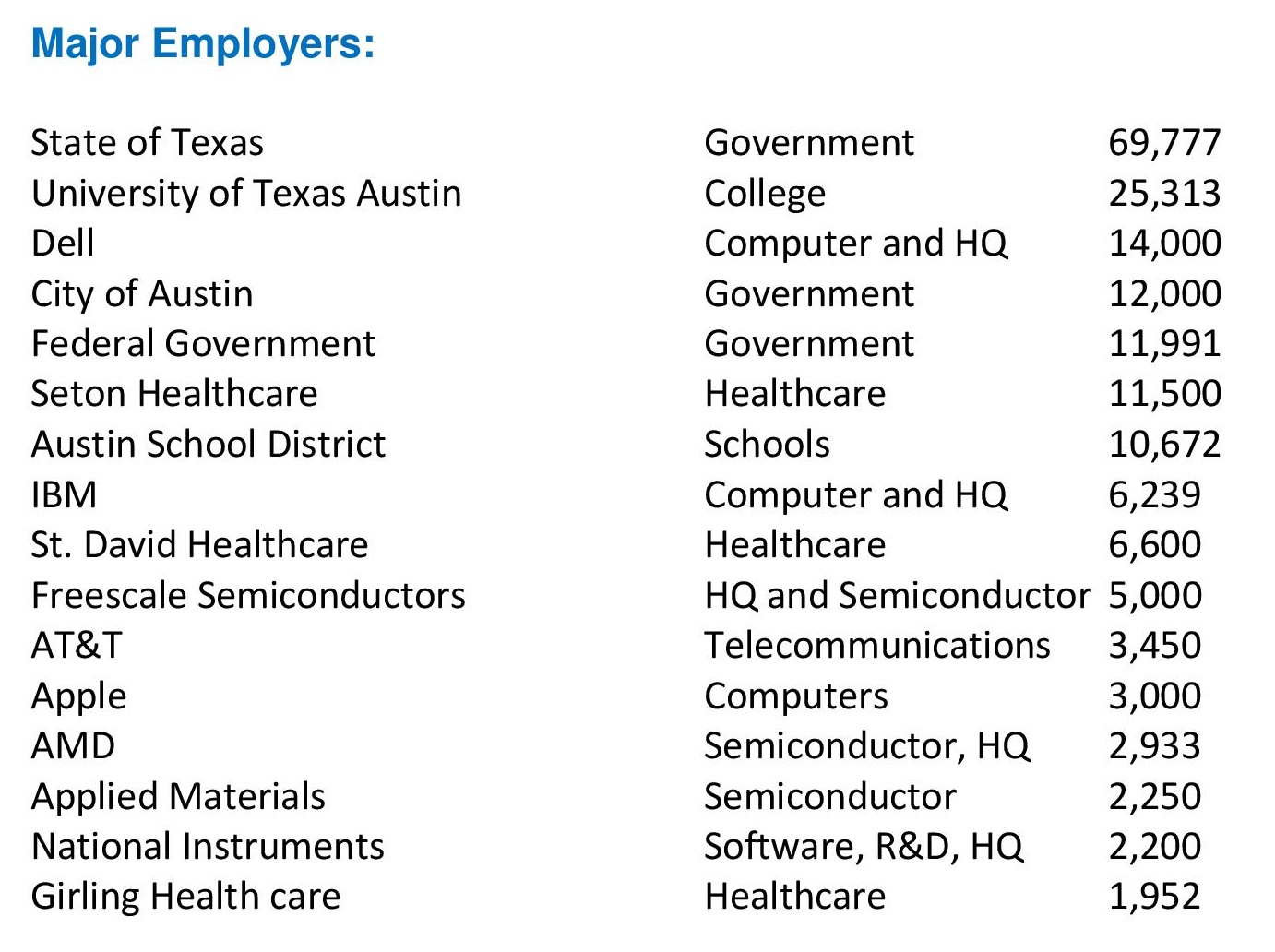

The second reason is the employment demographics of Austin. Some markets in Texas are more inundated with the energy markets, but Austin is not one of them. Austin’s job base, however, is made up of first and foremost government, education and tourism. These three sectors equate to nearly half of their entire employment base. Our analysis shows that those jobs are very recession proof. Government cut backs rarely occur and their workers are typically very secure in their jobs, even in Texas.

Then then next largest employment segments after these three are healthcare and technology. The healthcare industry looks to remain strong in the Austin area with the new $335 million dollar University of Texas at Austin medical school and Dell Medical center which is scheduled to open in 2016.

The job sector in Austin most vulnerable to negatives and fluctuations in the stock market is the tech industry. As you have might recall, we have made some predictions about significant volatility in the stock market and the potential for a major correction, we therefore made a deeper analysis on what that means for Austin’s tech employment segments. Our research shows that the tech companies who are now based in the Austin area are some of the heavy hitters in the tech world (AMD, Apple, Dell, Google and IBM to name a few) these companies obviously care about their company valuations but as some of the most cash rich and profitable companies in the world, we believe they could sustain most of their employment forces given a significant correction in the stock market.

The last reason we are very excited about Austin is the overall demographics. Austin is the young (median age 29.6), vibrant (live music capital of the world) and educated center of Texas. There is strong demand for employers and tourism, and given the affordability of this exciting city we see Austin as another market that is one of the most fundamentally sound investments in not only Texas but in the United States.

God Bless and Happy Investing,